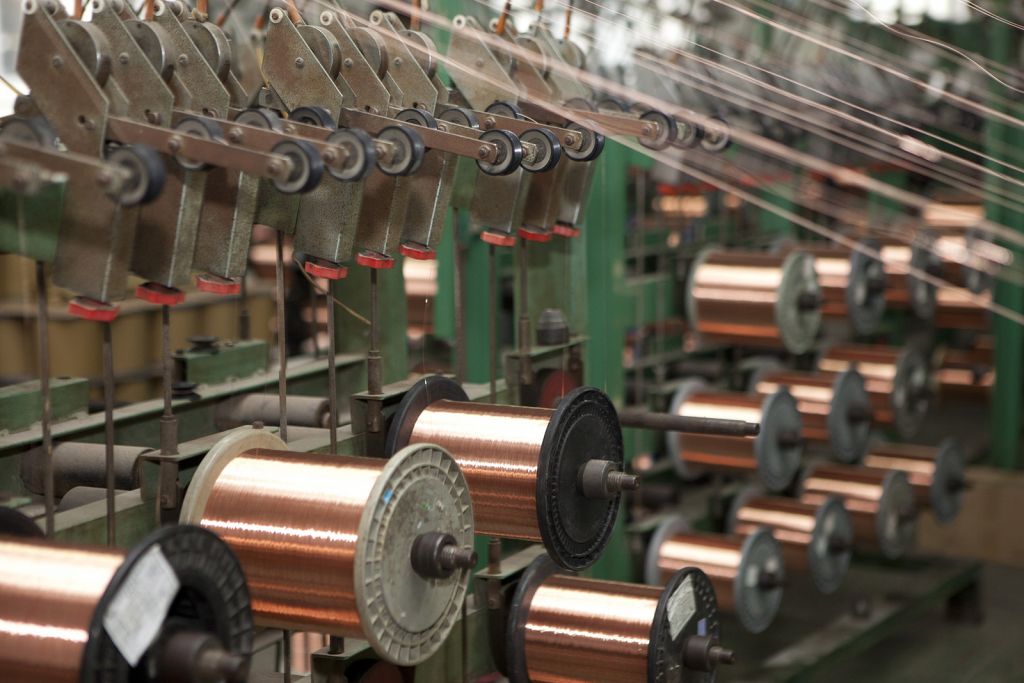

Copper prices fell more than 2% on Wednesday after data showed that manufacturing activities slowed in August in Europe and Asia. Production in China fell for the first time in nearly a year and a half.

Copper for delivery in December dropped to 2.3% from Tuesday's estimated price, reached $4.275 a pound ($ 9,405 a tonne) on the Comex market in New York.

The state reserves administration in China also released 150,000 tonnes of copper, aluminum and zinc on its third round of metal auctions that helped to cool the rally in copper prices. These actions were taken to reduce the pressure of high commodity prices on businesses. It is worth noting that sales, which began in early July, are the first in more than ten years. They come as prices of many commodities have hit a record-high in 2021 and President Xi Jinping has called for China to better manage its state reserves system.

This year, prices are still up 20%, after rising 26% in 2020, while analysts are optimistic that demand for the metal used in power grids, will grow as the world pursues towards electrification.

According to Citi analyst Oliver Nugent, fundamentals have improved in recent weeks, indicating a reduction in the exchange reserves, higher Chinese import premiums, the reduction of speculative positioning and expectations of further economic stimulus.

"Basically, we think we are at the right level,”he said.

"We see that next year the copper price will average just above $ 9,000."

English

English Русский

Русский 中文

中文